Are you feeling generous at year end? Taxpayers can transfer substantial amounts free of gift taxes to their children or other recipients each year through the proper use of the annual exclusion. The exclusion amount is adjusted for inflation annually, and for 2022, the amount is $16,000. The exclusion covers gifts that an individual makes … Read More

News

U.S. Treasury: Racial Equity Advisory

The U.S. Treasury Dept. recently formed a 25-member racial equity advisory committee. Among its goals are to “advance racial equity in the economy and address acute disparities for communities of color,” according to a statement. “Our current tax structures keep resources where they are and perpetuate the under-resourcing of certain communities,” one committee member said. … Read More

You may be liable for “nanny tax” for all types of domestic workers

You’ve probably heard of the “nanny tax.” But even if you don’t employ a nanny, it may apply to you. Hiring a house cleaner, gardener or other household employee (who isn’t an independent contractor) may make you liable for federal income and other taxes. You may also have state tax obligations. If you employ a … Read More

2022 – 11/04 – IRS: Office of Appeals

CPAs often are frustrated when working with the IRS Independent Office of Appeals on their clients’ behalf. On Nov. 2, committee members from the American Institute of Certified Public Accountants met with the IRS to discuss their issues. The CPAs said there’s often a “disconnect” between Appeals Officers (AOs) and their decision-making superiors. Issue coordinators … Read More

How inflation will affect your 2022 and 2023 tax bills

The effects of inflation are all around. You’re probably paying more for gas, food, health care and other expenses than you were last year. Are you wondering how high inflation will affect your federal income tax bill for 2023? The IRS recently announced next year’s inflation-adjusted tax amounts for several provisions. Some highlights Standard deduction. … Read More

IRS: Tax Fraud and Evasion

IRS Criminal Investigation’s (IRS-CI’s) special agents spend close to 70% of their time investigating crimes such as tax evasion and tax fraud and the rest investigating money laundering and drug trafficking. These facts and more are documented in the just-released IRS-CI 2022 Annual Report. In fiscal year 2022, IRS-CI agents identified more than $31 billion … Read More

New Markets Tax Credit

The U.S. Treasury Department has announced $5 billion in New Markets Tax Credit (NMTC) awards. The NMTC Program allows taxpayers to receive a nonrefundable tax credit against federal income tax for making equity investments in Community Development Entities (CDEs). CDEs that receive the tax credit allocation authority under the program are domestic corporations or partnerships … Read More

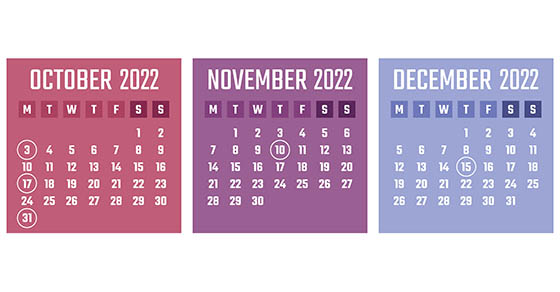

2022 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: … Read More

U.S. Treasury – Energy Efficient Deductions

Several nonprofits are concerned that the standard used by builders to claim a tax deduction for energy-efficient buildings is outdated. The Inflation Reduction Act expanded the standard under Code Sec. 179D. But in a recent letter to the U.S. Treasury Department, four organizations claim that although the new law reduced to 25% the savings threshold … Read More

Separating your business from its real estate

Does your business need real estate to conduct operations? Or does it otherwise hold property and put the title in the name of the business? You may want to rethink this approach. Any short-term benefits may be outweighed by the tax, liability and estate planning advantages of separating real estate ownership from the business. Tax … Read More