The Congressional Budget Office (CBO) is reporting that the fiscal year 2022 federal budget deficit will be lower than its $1 trillion projection made a few months ago. For the first nine months of fiscal year 2022, the deficit was $514 billion. The deficit recorded during the same period last year was $2.2 trillion, larger … Read More

News

The tax obligations if your business closes its doors

Sadly, many businesses have been forced to shut down recently due to the pandemic and the economy. If this is your situation, we can assist you, including taking care of the various tax responsibilities that must be met. Of course, a business must file a final income tax return and some other related forms for … Read More

IRS: Form 1099-K

If you’re a “gig worker” or freelancer, your tax obligations are different from an employee’s. You’re considered self-employed, so clients don’t withhold taxes from your payments. But even if they don’t send you information returns (such as Form 1099-K), you owe tax on that income. Gig workers may have to pay quarterly estimated taxes. Or, … Read More

How do taxes factor into an M&A transaction?

Although merger and acquisition activity has been down in 2022, according to various reports, there are still companies being bought and sold. If your business is considering merging with or acquiring another business, it’s important to understand how the transaction will be taxed under current law. Stocks vs. assets From a tax standpoint, a transaction … Read More

IRS: Employment Eligibility

Taxpayers can hire their children to work in their businesses but the children must hold legitimate jobs. In one case, a consultant and his wife’s estate weren’t entitled to business deductions for payments to “assistants,” who were the couple’s children and a grandchild. The payments were for alleged reimbursement or compensation for services provided in … Read More

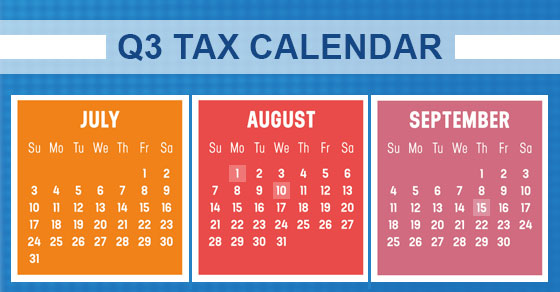

2022 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August … Read More

IRS: Federal EV credits

Toyota is the latest auto manufacturer to sell enough plug-in electric vehicles (EVs) to trigger a gradual phaseout of federal tax incentives for specified models sold in the U.S., joining Tesla and General Motors. Toyota reported that it has sold more than 200,000 EVs, meaning that its federal EV credits will begin to dwindle in … Read More

IRS: Tax incentives On Residential Real Estate

There are several tax incentives for owning residential real estate. For example, eligible taxpayers can claim home mortgage interest deductions and property tax deductions. If eligible, they can also exclude from gross income up to $250,000 ($500,000 for married couples filing jointly) of gain realized on the sale of a principal residence. The Joint Committee … Read More

Remote auditing: A brave new world

The pandemic has presented numerous challenges for businesses, but it also taught us how to be resilient, cost-conscious and adaptable. Over the last few years, we’ve learned that remote working arrangements offer many benefits, including reducing the time and cost of performing many tasks. Here’s how these lessons translate to the work auditors do to … Read More

IRS: Portability Extension

The IRS has updated the procedure for obtaining an extension to elect “portability.” Making a portability election allows a surviving spouse to apply a deceased spouse’s unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. To secure these benefits, however, the deceased spouse’s executor must … Read More