It’s National Veterans Small Business Week, and the IRS wants to help these business owners succeed. That’s why they’ve provided online resources, including these webpages: Self-Employed Individuals Tax Center, with relevant tips and references to tax rules; Small Business and Self-Employed Tax Center, with links to useful tools and common IRS forms and instructions; and … Read More

News

Temporary Tax Provision Expiry: New Markets, Work Opportunity, Empowerment Zone

Many temporary tax provisions have expired since the end of 2017. Many more will expire by Dec. 31, 2019. A bipartisan U.S. Senate Finance Committee has been charged with studying the effectiveness of the provisions and identifying options for long-term solutions. In the last of six reports on these provisions, the Employment and Community Development … Read More

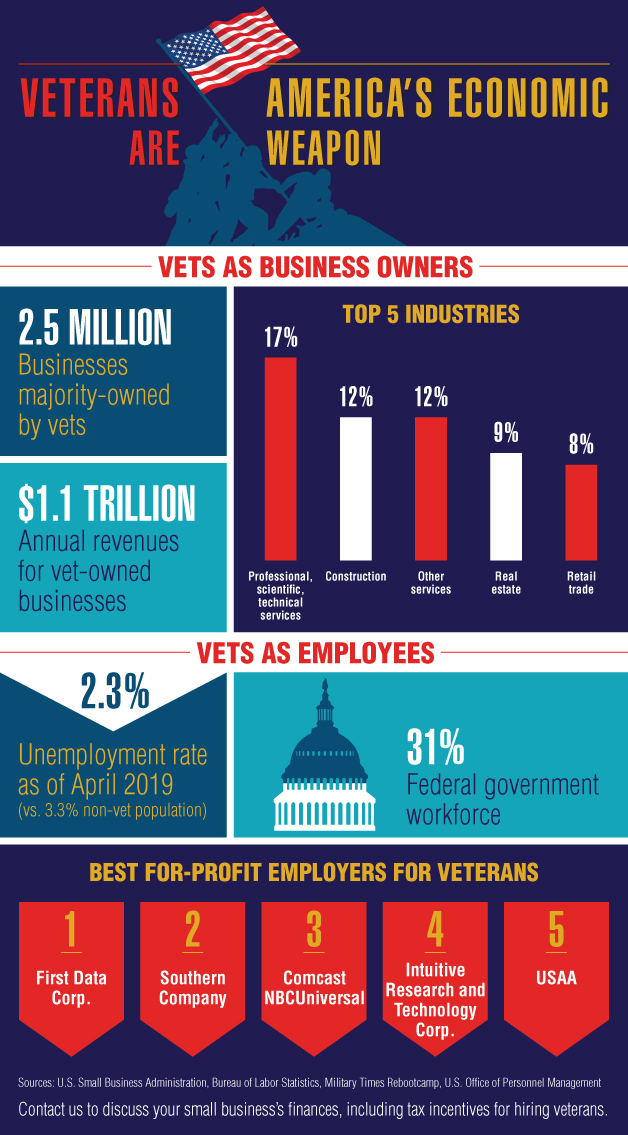

Veterans are America’s economic weapon

Happy Veterans Day! Thank you to all the Veterans who have proudly served our country. Veterans are America’s economic weapon. More than 250,000 service members transition out of the U.S. military every year.

IRS: Report of Foreign Bank and Financial Accounts (FBAR)

Taxpayers with certain foreign financial accounts must report them on their returns. They may also need to file a Report of Foreign Bank and Financial Accounts (FBAR) or face penalties. One taxpayer didn’t file FBARs for his Swiss accounts, prior to 2011. In 2011, he signed an agreement with the IRS to voluntarily disclose the … Read More

Avoid “Phishing” trips

Avoid “phishing” trips. More than 90% of all data thefts begin with a phishing email, according to the IRS. Cybercriminals use phishing emails and malware to gain control of computer systems or to steal usernames and passwords. One common tactic is “spear phishing.” This is when a thief poses as a trusted source and “baits” … Read More

IRS: Florida Highway Penalty Waived

The IRS is temporarily waiving the penalty for using dyed fuel on Florida highways. It took the step to minimize and prevent disruptions to the supply of fuel for diesel-powered highway vehicles because of Hurricane Dorian. The relief is available only if the vehicle operator, or the person selling the fuel, pays the tax of … Read More

U.S. Tax Court – Solar Equipment Accrual Method

The U.S. Tax Court ruled that a solar equipment manufacturer is required to use the accrual method of accounting. The court ruled that the manufacturer wasn’t entitled to use the installment sale method to report income from the sale of equipment it made. The reason: The equipment was personal property of the kind includible in … Read More

Is multicloud computing right for your business?

Cloud computing — storing data and accessing apps via the Internet — has been widely adopted by businesses across industry and size. Like many technological advances, though, new derivatives continue to emerge — including so-called multicloud computing. Under this approach, companies don’t rely on a single cloud service; rather, they distribute their data and computing … Read More

GAAP vs. tax-basis: Which is right for your business?

Most businesses report financial performance using U.S. Generally Accepted Accounting Principles (GAAP). But the income-tax-basis format can save time and money for some private companies. Here’s information to help you choose the financial reporting framework that will work for your situation. The basics GAAP is the most common financial reporting standard in the United States. … Read More

Thinking about converting from a C corporation to an S corporation?

The right entity choice can make a difference in the tax bill you owe for your business. Although S corporations can provide substantial tax advantages over C corporations in some circumstances, there are plenty of potentially expensive tax problems that you should assess before making the decision to convert from a C corporation to an … Read More