Do you have children under age 17? If so, and other qualifications are met, you may be eligible for the child credit. The maximum amount per qualifying child is $2,000 for 2019 and 2020. Up to $1,400 of that amount can be refundable for each qualifying child. That is, taxpayers can receive a refund up … Read More

News

A recent audit reveals that the IRS’s Criminal Investigation (CI) should increase its role in enforcement activities involving identity theft. A Treasury Inspector General for Tax Administration (TIGTA) audit found that, from 2013 to 2017, the number of identity theft investigations initiated by CI declined 75%. Auditors found that many taxpayer-initiated incidents of identity theft … Read More

IRS: FSA Contribution Limit Increase

Do you have a Flexible Spending Account (FSA) with your employer? Make sure to take full advantage of it in the new year. For 2020, the contribution limit will rise to $2,750 (up from $2,700 in 2019). If an employer chooses, employees can carry over up to $500 of unused funds into 2021. Otherwise, FSAs … Read More

IRS: Special Needs Adoption Credit

If you’re considering adopting a special needs child, you should know there may be financial help available in the form of an adoption credit. For 2020, the credit is $14,300 (up from $14,080 for 2019). For taxable years beginning in 2020, the maximum credit allowed for other adoptions is the amount of qualified adoption expenses … Read More

Selling securities by year end? Avoid the wash sale rule

If you’re planning to sell assets at a loss to offset gains that have been realized during the year, it’s important to be aware of the “wash sale” rule. Under this rule, if you sell stock or securities for a loss and buy substantially identical stock or securities back within the 30-day period before or … Read More

IRS: Interactive Tax Assistant

The IRS is encouraging taxpayers to use its “Interactive Tax Assistant” tool, which provides basic information on a wide range of tax topics. Topics are organized by category, such as the Affordable Care Act; filing requirements, forms to use and due dates; and filing status, dependents and exemptions. Other topics include pensions, IRAs, Social Security, … Read More

IRS: Earned Income Tax Credit

With the 2020 tax-filing season approaching, taxpayers may want to take time now to determine if they or their families are eligible for significant tax credits. For example, the Earned Income Tax Credit (EITC) is a refundable federal income tax credit for working people with low to moderate incomes. Certain eligibility requirements must be met. … Read More

Use a Coverdell ESA to help pay college, elementary and secondary school costs

You may be able to save for your child’s or grandchild’s education with a Coverdell Education Savings Account (ESA). There’s no upfront federal tax deduction for contributions, but the earnings grow tax-free. No tax is due when the account funds are withdrawn, to the extent the amounts don’t exceed the child’s qualified education expenses. Qualified … Read More

IRS: Inherited IRA Ruling

The IRS has ruled that an IRA wasn’t an inherited IRA after the deceased IRA owner’s wife was appointed sole beneficiary by a state court. Before the state court ruling, the only beneficiaries were the children of the deceased. In a private letter ruling, the IRS stated that, because the wife is entitled to the … Read More

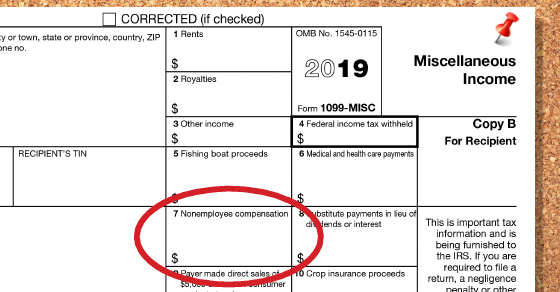

Small businesses: Get ready for your 1099-MISC reporting requirements

Early next year, your business may be required to comply with Form 1099 rules. You may have to send forms to independent contractors, vendors and others whom you pay nonemployee compensation, as well as file them with the IRS. There are penalties for noncompliance. Employers must provide a Form 1099-MISC for nonemployee compensation by Jan. … Read More