Have you applied for a business loan lately? Or had some repairs done on your facilities? Maybe you’ve signed a contract with a certain technologically inclined customer or vendor. In any of these instances, you (or one of your employees) probably had to electronically sign a digital document. So, the next question is: Why isn’t … Read More

News

Additional IRS Resources for 2021 Tax Season

Many people like to speak to a representative on the phone rather than being directed to online resources. The IRS is now providing more help to people who have overdue tax bills and need assistance. The agency is adding 800 phone line tax collection employees to provide phone assistance to taxpayers who have past-due tax … Read More

How business owners may be able to reduce tax by using an S corporation

Do you conduct your business as a sole proprietorship or as a wholly owned limited liability company (LLC)? If so, you’re subject to both income tax and self-employment tax. There may be a way to cut your tax bill by using an S corporation. Self-employment tax basics The self-employment tax is imposed on 92.35% of … Read More

Reporting Fortnight and Other Digital Currencies?

The IRS has removed two “in-game” virtual currencies, Roblox and V-bucks, from its list of examples of convertible virtual currencies. “Virtual” currency is a digital representation of value, other than real currency, that functions as a unit of account. “Convertible” virtual currency has an equivalent value in real currency. Roblox and V-bucks are “currencies” only … Read More

FAQs about audit confirmations

Auditors use various procedures to verify the amounts reported on your financial statements. In addition to reviewing original source documents and comparing trends from prior years, they may reach out to third parties — such as customers and lenders — to confirm that outstanding balances and estimates agree with their records. Here are answers to … Read More

Taxpayer Donation of Real Property

Taxpayers who donate a conservation easement may be able to take a charitable contribution deduction, if they follow certain rules. For example, donations must be a qualified real property interest to a qualified organization, exclusively for conservation purposes. A restriction on the use of the property must be granted “in perpetuity.” In one case, a … Read More

A Message From Mike: Important Tax Update Amidst COVID-19 Outbreak

I hope this finds you and your family well. I wanted to reach out to provide clarification, insight and support to you during this unprecedented challenging time. Tax Deadline for Individuals (1040) Federal: The United States Treasury Department and Internal Revenue Service announced this weekend that the federal income tax filing due date … Read More

IRS: Tax Checklist Made Easy

Do you dread tax time? Many taxpayers get bogged down hunting for receipts and documents in their mountains of paperwork, then scramble to get an appointment with their tax professional. The IRS has put together tips for taking the stress out of tax preparation. The key is having all the needed documents on hand, before … Read More

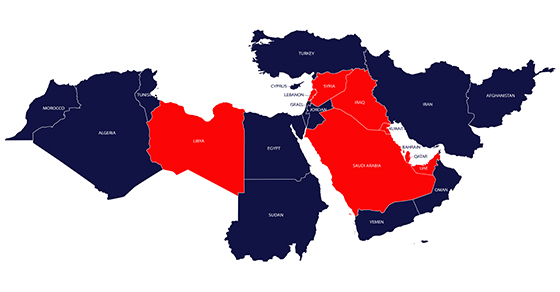

U.S. Treasury Boycott Countries – Subpart F Income

The U.S. Treasury Department has published a list of boycott countries, which will result in certain tax benefits being denied to people that participate in or cooperate with an unsanctioned international boycott. The list, issued this month, names countries that may require participation in, or cooperation with, an international boycott. The countries are Iraq, Kuwait, … Read More

Take steps to curb power of attorney abuse

A financial power of attorney can be a valuable planning tool. The most common type is the durable power of attorney, which allows someone (the agent) to act on the behalf of another person (the principal) even if the person becomes mentally incompetent or otherwise incapacitated. It authorizes the agent to manage the principal’s investments, … Read More