Summer is just around the corner. If you’re fortunate enough to own a vacation home, you may wonder about the tax consequences of renting it out for part of the year. The tax treatment depends on how many days it’s rented and your level of personal use. Personal use includes vacation use by your relatives … Read More

Author: Smeriglio Associates LLC

IRS: Request a Identity Protection PIN

Thanks to ongoing efforts by the IRS, state agencies and the accounting industry, tax fraud schemes where criminals use stolen identities to file for refunds are becoming less prevalent. One way you can protect yourself is by requesting an Identity Protection PIN (IP PIN) from the IRS. This is a six-digit number that must be … Read More

Tax issues to assess when converting from a C corporation to an S corporation

Operating as an S corporation may help reduce federal employment taxes for small businesses in the right circumstances. Although S corporations may provide tax advantages over C corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Here’s a quick rundown of the most important issues to … Read More

IRS: Matching Principle

U.S. businesses must generally follow strict rules in how they report income and expenses. One key rule is the matching principle, which requires that income and related expenses be reported in the same period. Even when a business strictly adheres to “generally accepted accounting principles” (GAAP), the IRS might challenge it. In one case, the … Read More

2022 – 04/13 – IRS: Fraudulent Tax Return

What happens if a thief steals your identity and files a fraudulent tax return? Although not all fraud can be easily detected, the IRS scans tax returns for possible fraud as they’re received. Returns that are flagged as suspicious will be pulled for extra review. If this happens with your return, you’ll receive an IRS … Read More

Fully deduct business meals this year

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants in 2022 (and 2021). So, you can … Read More

Qualified Opportunity Zone (QOZ) Program

The Qualified Opportunity Zone (QOZ) program allows investors to make long-term investments in distressed communities. More specifically, it allows investors who recognize capital gains to reinvest those gains in Qualified Opportunity Funds (QOFs) that, in turn, invest in one of nearly 9,000 designated QOZs. If you’ve made QOF investments, you may soon receive a letter … Read More

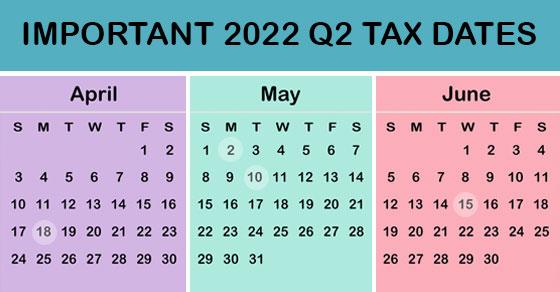

2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing … Read More

IRS: Taxpayer Advocacy Panel

The Taxpayer Advocacy Panel (TAP) is a group of volunteers that makes recommendations to the IRS about issues that affect ordinary taxpayers. As TAP’s website proudly states, “We’re the voice between the IRS and you.” The IRS isn’t obligated to act on every suggestion, nor does it. However, of the 126 items submitted to the … Read More

Taking the opposite approach: Ways your business can accelerate taxable income and defer deductions

Typically, businesses want to delay recognition of taxable income into future years and accelerate deductions into the current year. But when is it prudent to do the opposite? And why would you want to? One reason might be tax law changes that raise tax rates. There have been discussions in Washington about raising the corporate federal … Read More