If you’ve been in business for a while, you’ve probably considered many different employee benefits. One option that might have crossed your desk is an employee stock ownership plan (ESOP). Strictly defined, an ESOP is considered a retirement plan for employees. But it can also play a role in succession planning by facilitating the transfer of … Read More

Author: Smeriglio Associates LLC

IRS: Achieving a Better Life Experience

Achieving a Better Life Experience (ABLE) accounts can help support disabled individuals without affecting their eligibility for government benefits. Although contributions to an ABLE account aren’t tax-deductible, earnings are tax-deferred. Even better, if distributions are used by a beneficiary for specified disability-related costs, they’re tax-free. Family and friends may contribute up to $16,000 annually and … Read More

Key aspects of a successful wellness program

Wellness programs have found a place in many companies’ health care benefits packages, but it hasn’t been easy. Because these programs take many different shapes and sizes, they can be challenging to design, implement and maintain. There’s also the not-so-small matter of compliance: The federal government regulates wellness programs in various ways, including through the … Read More

IRS: October 17 Extension

If you’re one of the nearly 19 million taxpayers who requested an extension to Oct. 17 to file your 2021 tax return, the IRS is reminding you to claim all the tax breaks you’re entitled to. “Each year, eligible taxpayers overlook money saving deductions and credits that can help them with the cost of raising … Read More

Is it time for your business to fully digitize its accounts receivable?

With electronic payments and in-app purchases becoming so much the norm, many midsize to large companies have grown accustomed to software-driven accounts receivable. But there are some smaller businesses that continue to soldier on with only partially automated payment systems. If your company is still using paper-based processes, and suffering the consequences, it might be … Read More

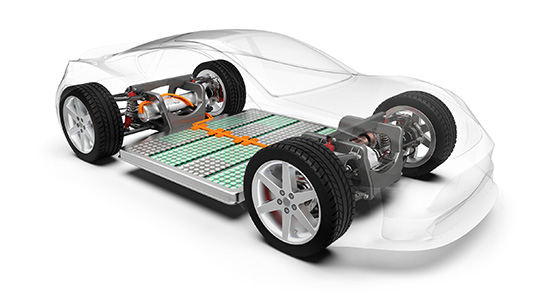

IRS: Clean Vehicle Credit

When it comes to the Clean Vehicle Credit (CVC) introduced by the Inflation Reduction Act (IRA), the devil is in the details. The CVC is an update to the previous $7,500 credit for the purchase of a new electric vehicle (EV), with major changes that phase in over time. One change that went into effect … Read More

IRS: Freedom of Information Act

Is the IRS improperly handling Freedom of Information Act (FOIA) requests? Taxpayers may request records from the IRS through the FOIA. To ensure that requests are properly handled, the Treasury Inspector General for Tax Administration (TIGTA) must annually review the process. After the IRS transitioned to an automated system (FOIAXpress), TIGTA reviewed a sample of … Read More

New law puts “book income” in the crosshairs

The Financial Accounting Standards Board (FASB) could have congressional lobbyists nipping at its heels over a “book minimum tax” rule in the newly enacted Inflation Reduction Act of 2022 (IRA). This would be the first corporate alternative minimum tax based on financial statement book income since the 1980s. And many in the accounting profession are … Read More

Are your risk-management practices keeping up with the times?

Risks abound in today’s uncertain marketplace. Nearly two-thirds of senior finance leaders said that the volume and complexity of corporate risks have changed “mostly” or “extensively” in the past five years, according to a new report published by the American Institute of Certified Public Accountants (AICPA) and North Carolina State University. Surprisingly, this report, 2022 … Read More

IRS: Clean Vehicle Credit

The U.S. government has begun issuing guidance regarding the Clean Vehicle Credit in the new Inflation Reduction Act (IRA). The IRA introduced a $4,000 tax credit for the purchase of used EVs and updated the $7,500 credit for new ones, with major changes. To qualify for the credit, there are now new requirements, including caps … Read More