Do you have an employer-provided vehicle? The IRS has issued final regulations about the limitation on the fleet-average rule. The final regs concern the special valuation rules for employers and employees to use in determining the amount to include in employee’s gross income for personal use of an employer-provided vehicle. The regs adopt proposed regs, … Read More

Author: Smeriglio Associates LLC

If you’re planning to move overseas, it’s time for an estate plan review

Whether you’re moving to another country for work-related reasons, retirement or simply want an opportunity to experience a new culture, it’s important to understand the potential tax and estate planning implications. If you don’t, you could be hit with some unpleasant surprises. Here are three possible pitfalls: Double taxation. If you’re a citizen of the … Read More

IRS: Health Insurance Marketplace Tax Credits

Individuals who have health coverage through the Health Insurance Marketplace may qualify for premium tax credits. The marketplace estimates the available credit based on the taxpayer’s application and pays the credits directly to the health plan. The taxpayer must then file Form 8962 (Premium Tax Credit) with his or her tax return, to reconcile estimated … Read More

IRS: Farmer of Commercial Fisher

Reminder: Many farmers and fishermen face a March 2 filing deadline. If you’re a farmer or work in the commercial fishing industry and you didn’t pay 2019 estimated tax by Jan. 15, your 2019 Form 1040 is due on Monday, March 2. A farmer or fisherman doesn’t have to pay estimated tax for a year … Read More

IRS: Meal & Entertainment Guidance

The IRS has released proposed regulations that address the elimination of the deduction related to entertainment, amusement or recreation activities. The Tax Cuts and Jobs Act (TCJA) revised the rules for deducting expenditures for meals and entertainment, effective for amounts paid or incurred after Dec. 31, 2017. The TCJA also repealed the directly related and … Read More

Coronavirus (COVID-19): Tax relief for small businesses

Businesses across the country are being affected by the coronavirus (COVID-19). Fortunately, Congress recently passed a law that provides at least some relief. In a separate development, the IRS has issued guidance allowing taxpayers to defer any amount of federal income tax payments due on April 15, 2020, until July 15, 2020, without penalties or … Read More

IRS Virtual Currency Reporting

As virtual currencies like bitcoin grow in popularity, how can the IRS ensure that people are paying the related taxes? Taxpayers must report and pay taxes on income from virtual currency transactions. But according to a recent report by the Government Accountability Office (GAO), the IRS guidance for proper reporting of this income is unclear. … Read More

What COVID-19 legislation means for nonprofits and their staffers

Whether your not-for-profit is newly deluged with demand for services or you’ve closed doors temporarily, it’s important to keep up with legislation responding to the coronavirus (COVID-19) crisis. On March 18, the Families First Coronavirus Response Act was signed into law to provide American workers affected by the pandemic with extended sick and family leave … Read More

IRS: Small Employer Less than $1,000 Tax Liability Notice

Small employers may qualify to change the way they report and pay payroll tax. Generally, employers file Form 941 (Employer’s Quarterly Federal Tax Return) each quarter. Small employers with annual federal employment tax liability of less than $1,000 may now file Form 944 (Employer’s Annual Federal Tax Return) by Jan. 31 of the following year. … Read More

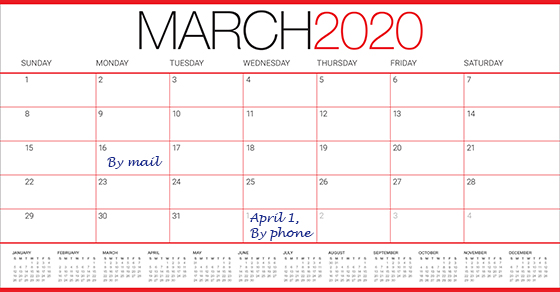

Individuals get coronavirus (COVID-19) tax and other relief

Taxpayers now have more time to file their tax returns and pay any tax owed because of the coronavirus (COVID-19) pandemic. The Treasury Department and IRS announced that the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020. Taxpayers can also defer making federal income tax payments, … Read More